A practical take on web3

April 26, 2022

Even just seeing the image above likely invokes strong emotion.

That thing your cousin told you about seven years ago (and that you should have bought) is now on every news station and trending daily on Twitter.

At this point I think most of us have heard of web3/cryptocurrencies. Without looking far you’ll see every imaginable take on the topic:

“Bitcoin will topple governments and protect you in the upcoming collapse of society.”

“In the future everything will be an NFT.”

“Holding USD is lighting your money on fire.”

It’s a wild-west sort of world filled with mania, FUD (that’s fear, uncertainty, and doubt), and jpegs of monkeys selling for life-changing amounts of money—and of course too many people losing everything.

It is possible to be excited for the future of a technology, participate in it, and also see it for what it is?

To see all of its possibility and also its shortcomings—and the variety of actors and motives in the space?

I hope so, and the entire point of this post is to attempt to give just that: a practical take on web3.

Two questions that may hold the answer

I think there are two important questions when it comes to evaluating web3:

- Is the technology useful?

- Will it succeed?

Is the technology useful?

Is blockchain a useful technology? To begin to answer that we need a simple definition of what a blockchain is and does:

A blockchain is a decentralized ledger of transactions across a peer-to-peer network.

Centralized ledgers

We use trusted third-party sources all the time.

The little green lock icon in the browser assures us that we’re buying from the real amazon.com and not some scam site.

Our banks’ records are the source of what transactions took place, and our legal system acts as the arbiter and final decision on disputes.

We trust these entities because they have significant power to squash imposters and right-the-wrongs. We have built a system that entrusts these large, powerful sources of truth to correctly vouch for the authenticity of an entity.

This centralized system works pretty well—or at least we haven’t had much of an option to use anything different for quite a while. That is, until now.

Decentralized ledgers

One of the new technological innovations from Bitcoin and adopted by other blockchains is distributed consensus in a peer-to-peer network.

In other words: the ability to put trust in a system where you can’t trust anyone.

But how can you trust someone is who they say they are without using a trusted third-party actor?

Alice: “Hey it’s me, Alice, and Bob said I can have all his money k thx.”

— Not something Bob said and also not Alice

The answer, is math (or cryptography).

Distributing consensus

In a distributed peer-to-peer network there is no central authority to validate the authenticity of communications. Peers within the network broadcast information to all other peers.

Imagine today if anyone could make any financial transaction they wanted at any time. A nightmare, right?

The creator(s) of Bitcoin solved this problem via Nakamoto Consensus. This consensus algorithm introduced what we know today as proof of work—or “mining.”

To contribute to the network, miners have to expend computation resources (energy from electricity and wear-and-tear on their hardware) to solve difficult cryptographic math puzzles. Solve the puzzle first and you win the right to submit and confirm a group of transactions (or block) and receive the reward for doing said work (i.e., in the Bitcoin network you earn a few Bitcoin).

These new transactions are then propagated to all other nodes in the network where they are cryptographically verified—and if correct—each peer in the system in turn updates their internal state to match the new system state.

This is obviously a simplified view, but the important point is that this distributed consensus method removes the need for a trusted third-party.

Also, the security and stability of the network grows with each new honest participant verifying the network's transactions. Participants in the network are also incentivized to act honestly and continue supporting the network via one of the most powerful incentives out there—getting paid.

Ownership

Distributed consensus actually enables another interesting feature: digital ownership.

Today, if the government wanted to seize your property or collect funds from your bank account they could do it with very little effort. If Spotify wanted to remove all of your favorite songs from their catalog or delete all of your playlists—they could.

There may be consequences for these actions, but there’s very little you or I could do to stop them. These bits of data aren’t ours—they’re stored on someone else’s servers and very easily altered when the right person comes knocking.

We have access to these systems, but we don’t inherently own the data.

Contrast this with a distributed ledger:

If a distributed ledger shows that you own some thing X—and no actor or group of actors can alter the ledger to remove that thing from you—you truly do own that thing.

Thanks to a large sprinkle of cryptography, only the person who knows the private key to that account can provide the proof to transact on that account.

(An aside here: this ownership is all well and good but it is still susceptible to a wrench attack.)

Summing it up so far

If we take a checkpoint here and evaluate these two properties: distributed consensus and ownership—a couple questions for you:

- Would you prefer the source of truth and arbiter of transactions to be powerful organizations or a large network of individuals backed by cryptography?

- Would you prefer the owner of digital items to be organizations or individuals?

For me, the answer is obvious: give the power to the people.

Is the technology useful?

So to answer the first question: yes I do believe this is a useful technology.

It is not perfect and it has flaws (which we’ll talk about), but in the end I believe this technology in its current form and projected future will empower the individual in a space that has largely been dominated by the biggest and most powerful players.

Do I think governments should be abolished and every item in our physical world be represented as an item on a blockchain? No, of course not.

Is there room for improvement and innovation in our systems today where blockchain technology could facilitate that improvement? I think so, yes.

Will it succeed?

If we have a useful technology, will it succeed?

A useful technology is great, but if that technology doesn’t functionally work, isn’t able to adapt and evolve, or never reaches wide enough distribution in the market, it in effect is not useful.

Asking whether a particular blockchain or some of the blockchain systems will succeed in the long term is likely just speculation, but the overall story seems good. Metrics like transactions and active addresses are "up and to the right."

A study from the University of Chicago found that "more than 1 in 10 Americans invested in cryptocurrency over the past year."

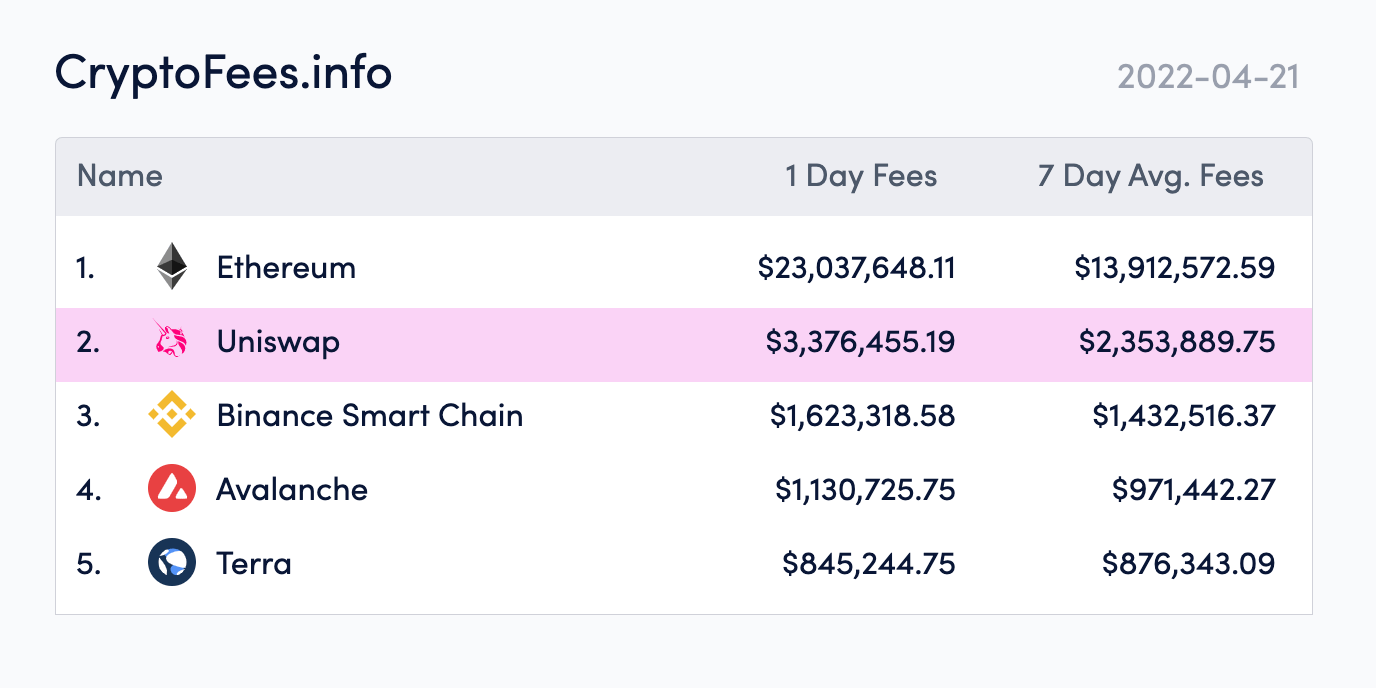

The amount of revenue being generated from the various blockchains and projects within them is also no small amount either.

Anecdotally, it also seems like the number of crypto companies and investments are ever-increasing as well—and while these metrics in and of themselves don't prove success, they are very positive factors.

EIP-1559

One story that stands out to me in particular is the recent Ethereum upgrade to EIP-1559.

For those not familiar with the upgrade, this proposal changed the way in which transaction fees were paid and used in a transaction.

The proposal was a large change: it took almost two years of planning, required miners of the network to coordinate and update their systems—which is no small feat in a large, distributed network—and it went off without a hitch.

To me, a successful change like this on the largest smart contract network (and largest network next to Bitcoin) is a very positive sign for this ecosystem succeeding.

Valid criticisms

Now while I do believe there are innovative new technology solutions being created and deployed in the web3 space, there are also many valid criticisms of the current system, and any honest or practical take on web3 would have to discuss them and give them credit where due.

To avoid or ignore these criticisms would actively harm the web3 space. Even in the harshest of criticisms there’s often a hint of truth.

So, here are some of the most common takes you’ll find on the web today.

Take 1: Crypto will overthrow our monetary policy and governments

There is a subset of the crypto community that believes crypto (and web3) will allow us to become completely free from the control of the governments of the world and their monetary systems.

Could crypto allow you to live, work, and transact in a monetary system completely outside of the governments reach? Theoretically...yes? I wouldn’t say it’s impossible but it’s also extremely unlikely. Governments like their control of money and won’t relinquish it easily.

I find it very unlikely that even a united, worldwide self-sovereign cryptocurrency coalition could last long against even a few governments of the world—let alone a joined effort.

The fact of the matter is that we rely too much on shared services (internet, electricity, supply chains) that are ultimately critical points in the cryptocurrency space as well, and government intervention at these points would probably mean lights out for crypto.

Crypto and fiat will likely co-exist

In reality, cryptocurrencies becoming more popular likely means the governments will tax these innovations and put some regulations in place. How much, when, and how? No one knows, but I would bet that our governments are neither overthrown nor squash crypto entirely, but adapt to it and make a ton of tax money off of it.

Crypto may allow us to claw back agency and power within certain systems, but I find it very unlikely that it topples our financial systems.

Take 2: Environmental/energy usage

One of the main criticisms about cryptocurrency is the energy usage it requires to keep a blockchain active. This is related to the previously described proof-of-work consensus algorithm which requires computers to solve computationally-expensive equations in order to win the right to mine the next block.

These two passages from the HBR article “How Much Energy Does Bitcoin Actually Consume?” offer some opposing viewpoints:

Bitcoin currently consumes around 110 Terawatt Hours per year — 0.55% of global electricity production, or roughly equivalent to the annual energy draw of small countries like Malaysia or Sweden. This certainly sounds like a lot of energy. But how much energy should a monetary system consume?

How you answer that likely depends on how you feel about Bitcoin. If you believe that Bitcoin offers no utility beyond serving as a ponzi scheme or a device for money laundering, then it would only be logical to conclude that consuming any amount of energy is wasteful. If you are one of the tens of millions of individuals worldwide using it as a tool to escape monetary repression, inflation, or capital controls, you most likely think that the energy is extremely well spent.

In the article, that last paragraph ends with this sentence which I think sums it up well:

“Whether you feel Bitcoin has a valid claim on society’s resources boils down to how much value you think Bitcoin creates for society.”

What are blockchains worth?

Your idea of the value of Bitcoin (both to your portfolio and societally) likely determines how you feel about this. I for one land somewhere in the middle.

One aspect of this environment/energy issue I find interesting is I almost never see any kind of content around reducing power consumption in other ways.

I don’t see any articles on the power draw of the world’s Netflix consumption, or video gaming, or watching Youtube or streamers. I don’t hear anything about people using and charging their devices less, or using minimal power in their homes for periods of time.

I also don’t see any content around the power draw of the millions of companies worldwide with all of their equipment, servers, databases, and other cloud infrastructure running 24/7.

And while the cost of Bitcoin is significant (and the article also brings up other interesting aspects about the details of that power), if it is providing a valuable world-wide financial service, should we not then compare it to the power our other financial systems are using?

Proof of Stake

One of the best solutions to the energy problem is already in play, and that is a newer consensus algorithm known as proof of stake.

Instead of the proof of work method of solving an energy-intensive math puzzle, proof of stake networks have their “miners” (often called validators) put up a large stack of collateral (usually the native token of the network) which can be slashed (taken away) if the validator behaves incorrectly. Malicious or incorrect behavior means losing cash—so it is a powerful incentive.

Removing the heavy computation component in the consensus algorithm reduces the energy use of the network dramatically.

Ethereum currently uses proof of work, but it has been planning and rolling out a proof of stake mechanism for quite some time now, and it is believed to go live later this year. At that point, the energy usage of Ethereum is said to drop by 99%.

(Although as of now Bitcoin, the largest energy consumer, has no plans to move away from proof of work.)

Take 3: Scams/ponzis/hacks

Right out of the gate: there are definitely lots of scams, ponzis, and hacks within cryptocurrency. No question about that.

There are also a countless number of these things outside of cryptocurrency. If we banned every technology that facilitates scams we’d have no technology.

Over time and as the space matures, I do think the number of scams will decrease. There will always be scams, but it’s easy to scam people who are undereducated about the underlying technology and don’t yet have good patterns and tools to use to identify scams versus legitimate projects.

Another aspect to keep in mind is blockchains are completely open and public data. You can watch and analyze every transaction that happens on-chain.

How many scams and hacks do you think we would find if we could see every financial transaction in every system worldwide?

Take 4: NFTs

By now everyone knows the word NFT. Thinking of this word might conjure images of monkeys selling for millions of dollars—and that seems crazy. And you know what? It is kind of is crazy.

(Although most of the prominent people in the NFT space have been saying for quite a while that this is in fact a bubble and most NFTs will go to $0.)

On one hand you might attribute this to money laundering, greed, or something else—and there’s probably some truth to those—but on the other hand we see predictable patterns of traders, collectors, communities, and status games.

Is a monkey picture really worth $1.5M? It is if someone is willing to pay that price. I might disagree, you might disagree, but for whatever reason—right or wrong—someone is willing to pay it.

What does that $1.5M get them? A ticket to a social group they find elite and valuable? A speculative trade they might profit off of? Some artwork they like?

NFTs: Programmable identity

When a new tech arrives, people build and cling to what they know. It takes some time for the truly innovative and next-gen applications to arise.

First smartphone in your pocket? What if we added email??

After cryptocurrencies were created what’s the first thing we built? Trading.

Right now NFTs are going through the same thing. Some people see them as art, some see them as membership to a status club or maybe just a collector’s item to be traded—and that’s fine.

I think there’s an underutilized aspect of NFTs that I don’t see many people using: programmable identity.

NFTs are unique by definition (”non-fungible” token). They’re also software objects that can be manipulated through code.

We are drastically underutilizing this aspect of NFTs. NFTs could represent access, ability, and that access and ability could change programmatically based on any factor the developers can dream of.

I’m not really into trading jpgs, but this programmable identity aspect is really fascinating to me.

As an example, I recently saw this generative tree/seed piece of art NFT. The owner of the NFT can decide how many “offspring” trees to generate—or not generate. The collection and artwork evolves based on the owners actions.

I find ideas like really cool, and it's only just the beginning.

There’s a lot of people in crypto

There’s a lot of people in crypto. As it spreads globally it picks up global diversity as well. Every person has a unique motivation.

Some want to scam. Some want to make quick money off of others (but not as a scam). Some want to build. Some want to overthrow. Some want to belong.

I could go on and on about different takes and positions within the crypto world, but ultimately I think the important thing to realize is everyone has a motive (good or bad)—and everyone has bias.

You will see a lot of extreme takes in crypto—from the “overthrow the government” to the “everything will become an NFT.”

One person or one subset doesn’t define the whole. Every possible motivation will be present—as in any other area of life.

Energy

One underrated aspect of web3 culture is the energy. People are truly excited to be a part of and working in web3.

I originally underestimated the power of this energy. It’s infectious, and it brings enthusiasm to those who are learning and building in the space.

The web3 space also has adopted an almost silly aspect to its culture. Memes reign supreme.

Even the design of many of the web3 products and companies has more freedom and expression from the standard web2 marketing pages. It’s a refreshing change.

Asymmetric upside

Finally, I think there’s one final point that many developers today are missing.

If you are a developer now or looking to become one, I think there is asymmetric upside to diving into web3 right now.

If you're right, you get to ride the next wave of technological advancement. If you're wrong, you learned a few new skills that may or not be useful, but the odds are thinking and working in distributed systems will at a minimum be useful time spent.

In fact, one of the reasons I gave web3 a chance was because I didn’t want to look back twenty years from now and say that I was on the edge of the next technological revolution—and I missed it. I wondered if there were developers who saw the rise of the internet and apps and ignored it, or thought it would never succeed, or wondered how it could ever be useful.

I don’t want to be that person for web3.

I could be totally wrong

I could be totally wrong. I could be wrong about the utility, the ability for these communities to succeed, or just the overall impact this technology will make.

Maybe everything becomes an NFT and every app has a blockchain layer. Or maybe blockchain tech is deployed like machine learning or AI—in specialized, highly-technical use-cases (although many companies are now popping up now to give the everyday-company ML/AI on top of their data).

Or maybe crypto peters out and a few years from now I’m back in the web2 world fully—and this web3 adventure is just a chunk of time I spent on a new shiny thing.

If that happens, I will be happy to admit I was wrong.

But overall, I’ve seen enough to commit to this thing for the time being. Web3 seems like a risk well-worth taking, and with very little downside.

In the worst case, I’ll have made some new friends and web2 will be waiting for me again.

Thanks for reading. If you have questions or comments feel free to reach out to me on Twitter.